Enlarge image

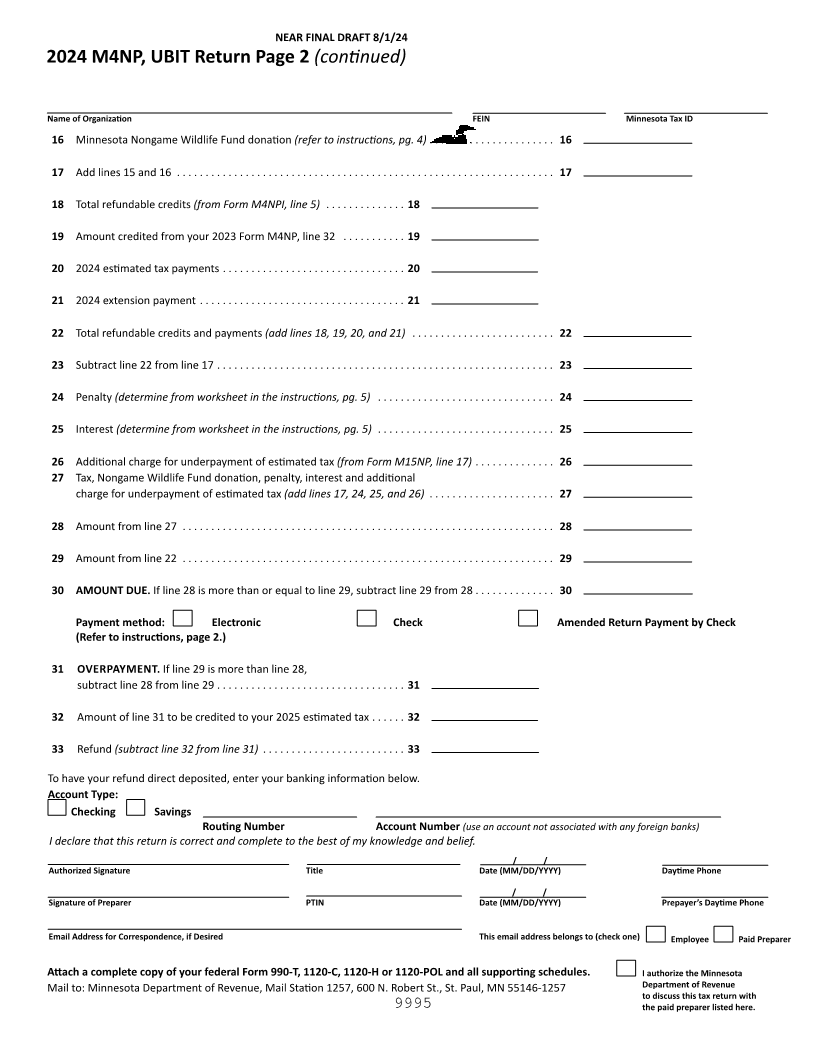

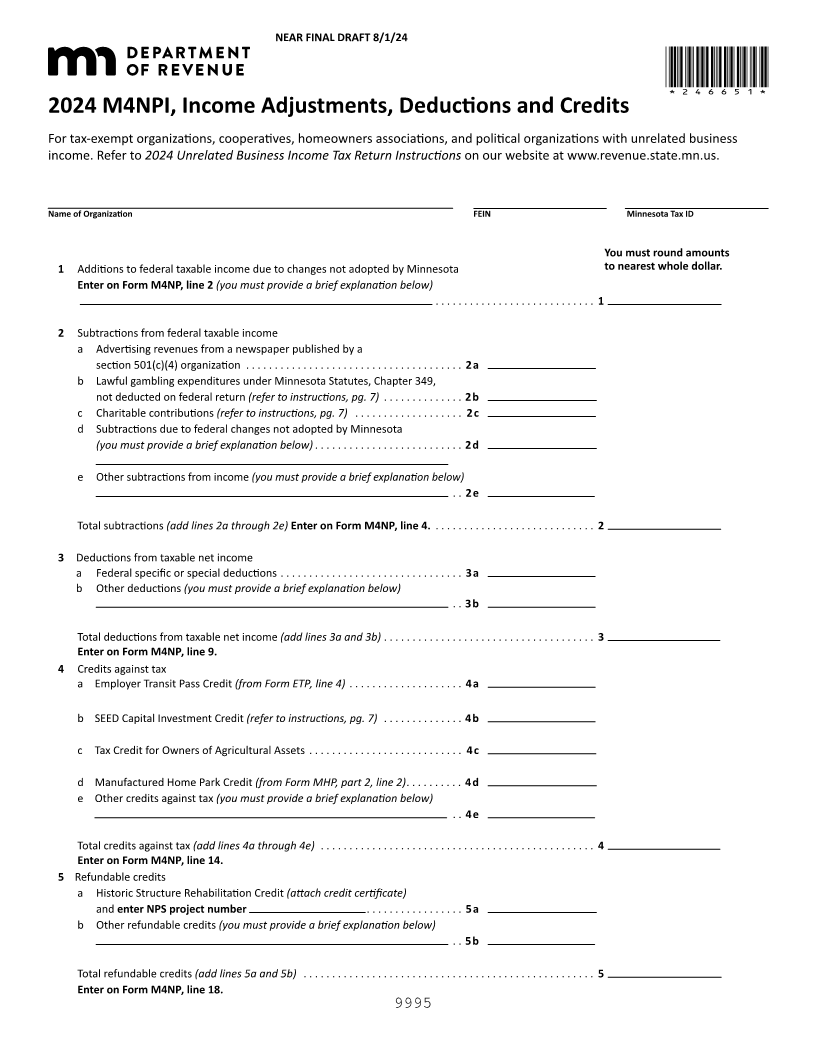

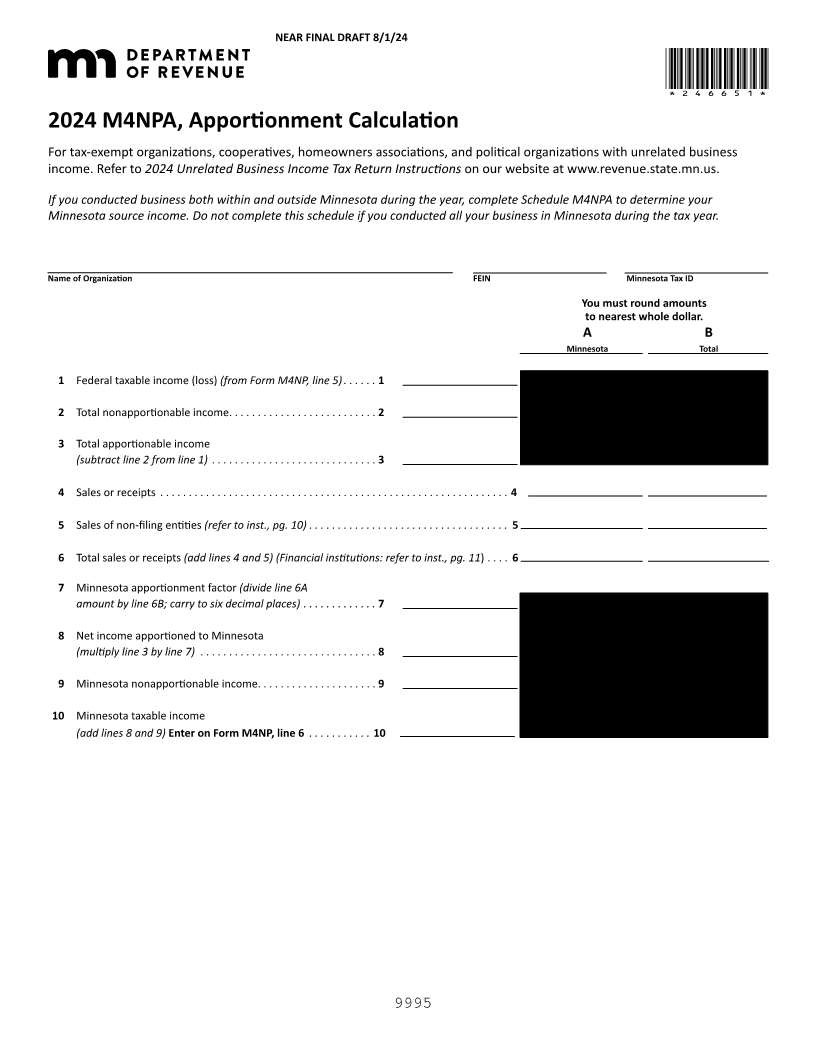

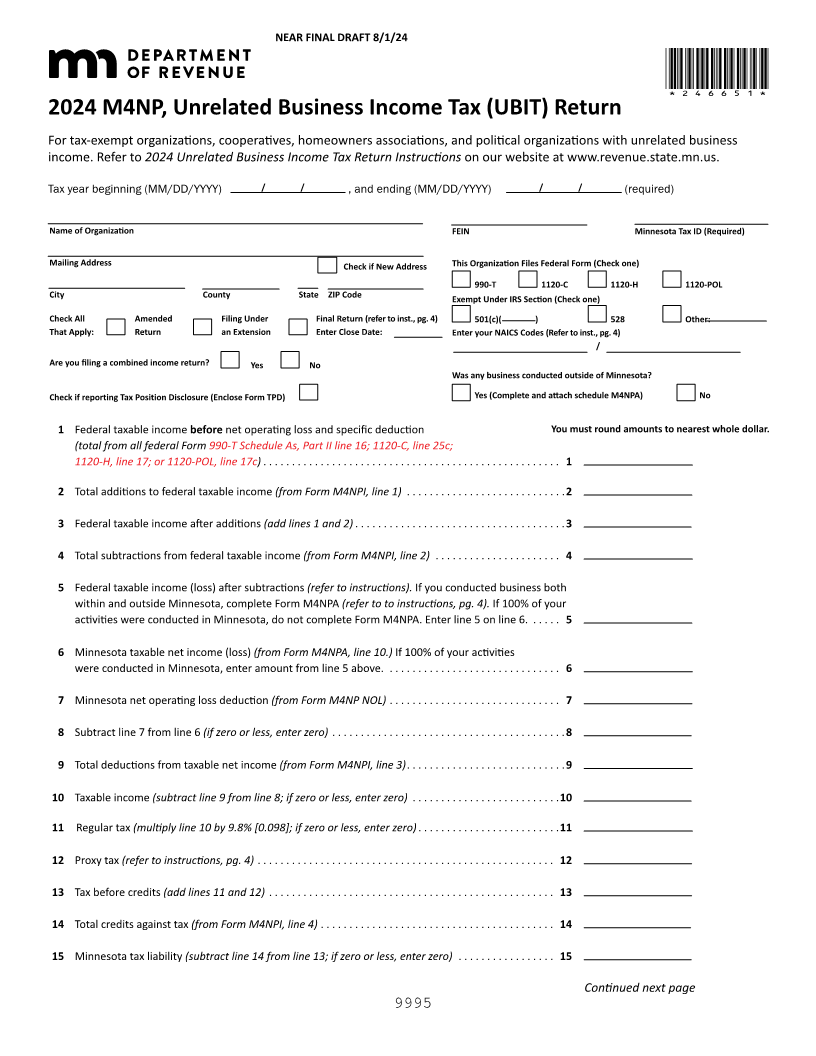

NEAR FINAL DRAFT 8/1/24

*246651*

2024 M4NP, Unrelated Business Income Tax (UBIT) Return

For tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business

income. Refer to 2024 Unrelated Business Income Tax Return Instructions on our website at www.revenue.state.mn.us.

Tax year beginning (MM/DD/YYYY) / / , and ending (MM/DD/YYYY) / / (required)

Name of Organization FEIN Minnesota Tax ID (Required)

Mailing Address Check if New Address This Organization Files Federal Form (Check one)

990-T 1120-C 1120-H 1120-POL

City County State ZIP Code Exempt Under IRS Section (Check one)

Check All Amended Filing Under Final Return (refer to inst., pg. 4) 501(c)( ) 528 Other:

That Apply: Return an Extension Enter Close Date: Enter your NAICS Codes (Refer to inst., pg. 4)

/

Are you filing a combined income return? Yes No

Was any business conducted outside of Minnesota?

Check if reporting Tax Position Disclosure (Enclose Form TPD) Yes (Complete and attach schedule M4NPA) No

1 Federal taxable income before net operating loss and specific deduction You must round amounts to nearest whole dollar.

(total from all federal Form 990-T Schedule As, Part II line 16; 1120-C, line 25c;

1120-H, line 17; or 1120-POL, line 17c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total additions to federal taxable income (from Form M4NPI, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Federal taxable income after additions (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total subtractions from federal taxable income (from Form M4NPI, line 2) . . . . . . . . . . . . . . . . . . . . . . 4

5 Federal taxable income (loss) after subtractions (refer to instructions). If you conducted business both

within and outside Minnesota, complete Form M4NPA (refer to to instructions, pg. 4). If 100% of your

activities were conducted in Minnesota, do not complete Form M4NPA. Enter line 5 on line 6. . . . . . 5

6 Minnesota taxable net income (loss) (from Form M4NPA, line 10.) If 100% of your activities

were conducted in Minnesota, enter amount from line 5 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Minnesota net operating loss deduction (from Form M4NP NOL) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Subtract line 7 from line 6 (if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8. . .

9 Total deductions from taxable net income (from Form M4NPI, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . 9. .

10 Taxable income (subtract line 9 from line 8; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . .10

11 Regular tax (multiply line 10 by 9.8% [0.098]; if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . .11

12 Proxy tax (refer to instructions, pg. 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Tax before credits (add lines 11 and 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total credits against tax (from Form M4NPI, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Minnesota tax liability (subtract line 14 from line 13; if zero or less, enter zero) . . . . . . . . . . . . . . . . . 15

Continued next page

9995