Enlarge image

NEAR FINAL DRAFT 8/1/24

*248011*

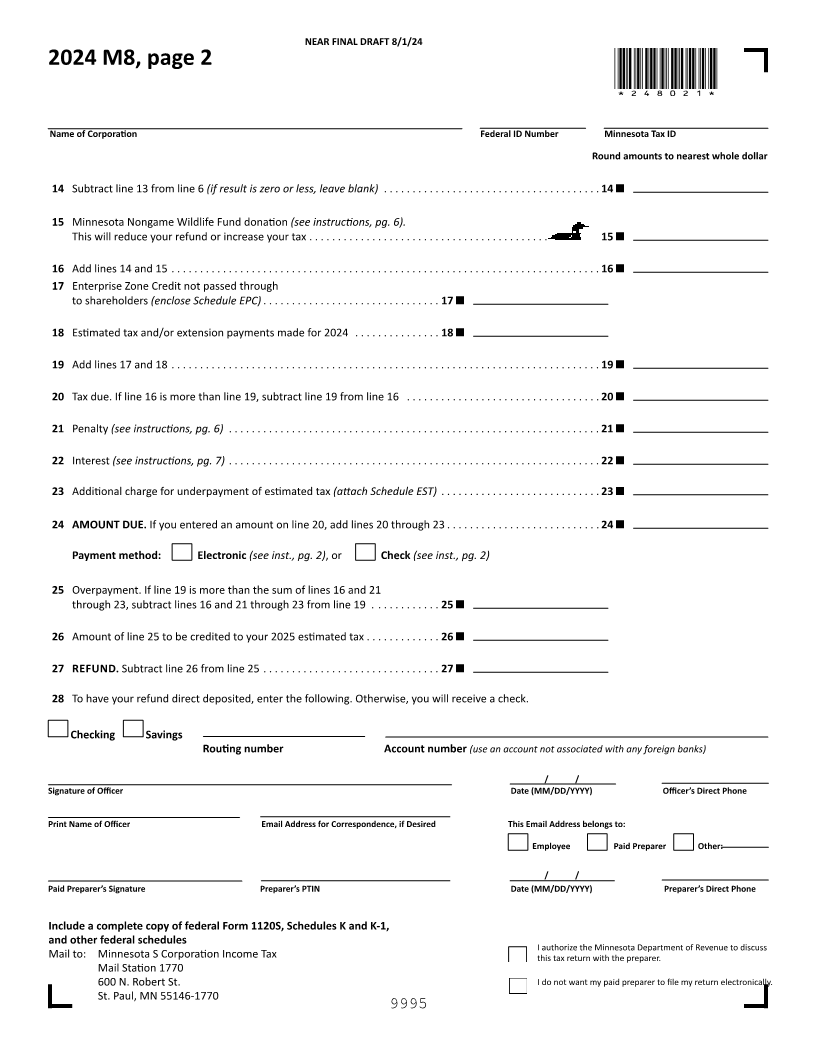

2024 M8, S Corporation Return Do not use staples on anyting you submit.

Tax year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / /

Name of Corporation Federal ID Number Minnesota Tax ID

Mailing Address Check if New Address Former name, if changed since 2023 return:

City State ZIP Code Number of Schedule KS Number of Shareholders

Place an X in all that apply:

Initial Composite Financial Qualified Subchapter Final Return Installment Sale of Pass-

Return Income Tax Institution S Subsidiary through Assets or Interests

Public Pass-through Tax Position Disclosure

Law Entity (PTE) Tax (Enclose Form TPD)

86-272

1 S corporation taxes (place an X in all that apply):

Federal Schedule D taxes Passive income Round amounts to nearest whole dollar

LIFO recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 (enclose computation)

2 Minimum fee from M8A, line 9 (see M8A instructions, pg. 9) . . . . . . . . . . . . . . 2 (enclose M8A)

3 Pass-through Entity Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 (enclose Schedule PTE)

4 Composite income tax for nonresident shareholders . . . . . . . . . . . . . . . . . . . . 4 (enclose Schedules KS)

5 Minnesota income tax withheld for nonresident shareholders.

If you received Form AWC from a shareholder, check box: 5 (enclose Forms AWC)

6 Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Employer Transit Pass Credit not passed through to shareholders

(enclose Schedule ETP) ... ...... ....... ..... ..... ...... ..... ...... ...... ...... ..... ...... ..... .. 7

8 Film Production Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Enter the credit certificate number: TAXC -

9 Tax Credit for Owners of Agricultural Assets not passed through to shareholders

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Enter the certificate number from the certificate you received from the

Rural Finance Authority:

AO

10 State Housing Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Enter the credit certificate number from Minnesota Housing: SHTC - -

11 Short Line Railroad Infrastructure Modernization Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Credit for Sales of Manufactured Home Parks to Cooperatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add lines 7 through 12, limited to the sum of lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

9995 Continued next page