Enlarge image

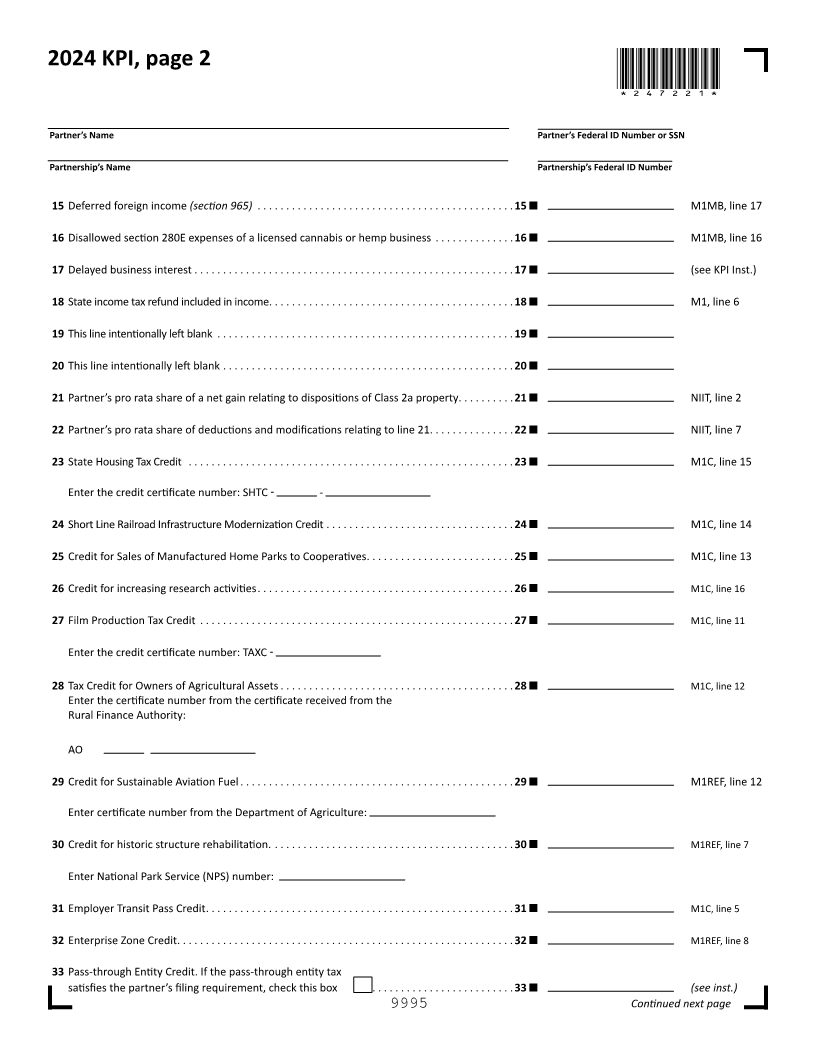

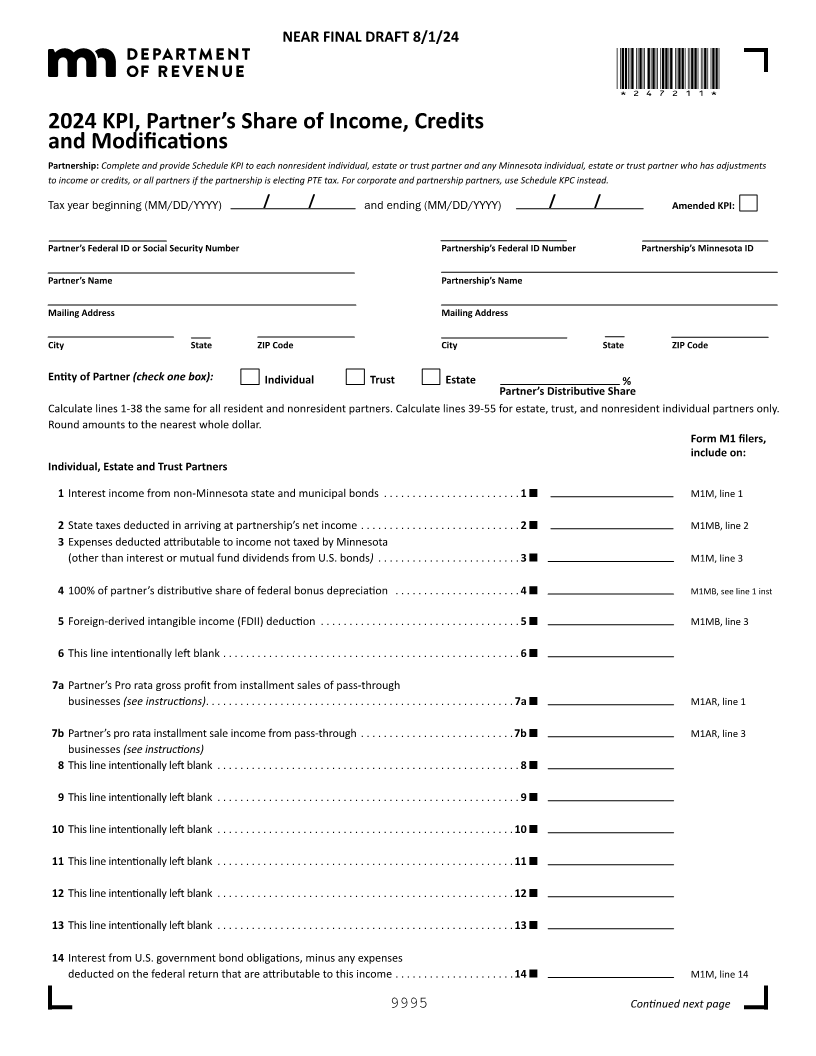

NEAR FINAL DRAFT 8/1/24

*247211*

2024 KPI, Partner’s Share of Income, Credits

and Modifications

Partnership: Complete and provide Schedule KPI to each nonresident individual, estate or trust partner and any Minnesota individual, estate or trust partner who has adjustments

to income or credits, or all partners if the partnership is electing PTE tax. For corporate and partnership partners, use Schedule KPC instead.

Tax year beginning (MM/DD/YYYY) / / and ending (MM/DD/YYYY) / / Amended KPI:

Partner’s Federal ID or Social Security Number Partnership’s Federal ID Number Partnership’s Minnesota ID

Partner’s Name Partnership’s Name

Mailing Address Mailing Address

City State ZIP Code City State ZIP Code

Entity of Partner (check one box): Individual Trust Estate %

Partner’s Distributive Share

Calculate lines 1-38 the same for all resident and nonresident partners. Calculate lines 39-55 for estate, trust, and nonresident individual partners only.

Round amounts to the nearest whole dollar.

Form M1 filers,

include on:

Individual, Estate and Trust Partners

1 Interest income from non-Minnesota state and municipal bonds ..... ..... ...... ..... ... 1 M1M, line 1

2 State taxes deducted in arriving at partnership’s net income . ..... ...... ...... ..... ..... 2 M1MB, line 2

3 Expenses deducted attributable to income not taxed by Minnesota

(other than interest or mutual fund dividends from U.S. bonds) ... ...... ..... ...... ..... 3 M1M, line 3

4 100% of partner’s distributive share of federal bonus depreciation . ..... ..... ...... ..... 4 M1MB, see line 1 inst

5 Foreign-derived intangible income (FDII) deduction .... ...... ...... ...... ..... ...... .. 5 M1MB, line 3

6 This line intentionally left blank ... ...... ..... ...... ..... ...... ..... ...... ...... .... 6

7a Partner’s Pro rata gross profit from installment sales of pass-through

businesses (see instructions)... ...... ..... ....... ..... ..... ...... ..... ...... ...... 7a M1AR, line 1

7b Partner’s pro rata installment sale income from pass-through .. ...... ..... ....... ..... .. 7b M1AR, line 3

businesses (see instructions)

8 This line intentionally left blank . ..... ...... ..... ....... ..... ...... ..... ...... ...... . 8

9 This line intentionally left blank . ..... ...... ..... ....... ..... ...... ..... ..... ....... . 9

10 This line intentionally left blank . ..... ...... ..... ....... ..... ...... ..... ..... ....... 10

11 This line intentionally left blank . ..... ...... ..... ....... ..... ...... ..... ..... ....... 11

12 This line intentionally left blank . ..... ...... ...... ...... ..... ...... ...... ..... ...... 12

13 This line intentionally left blank . ..... ...... ...... ...... ..... ...... ...... ..... ...... 13

14 Interest from U.S. government bond obligations, minus any expenses

deducted on the federal return that are attributable to this income ... ..... ...... ...... . 14 M1M, line 14

9995 Continued next page