Enlarge image

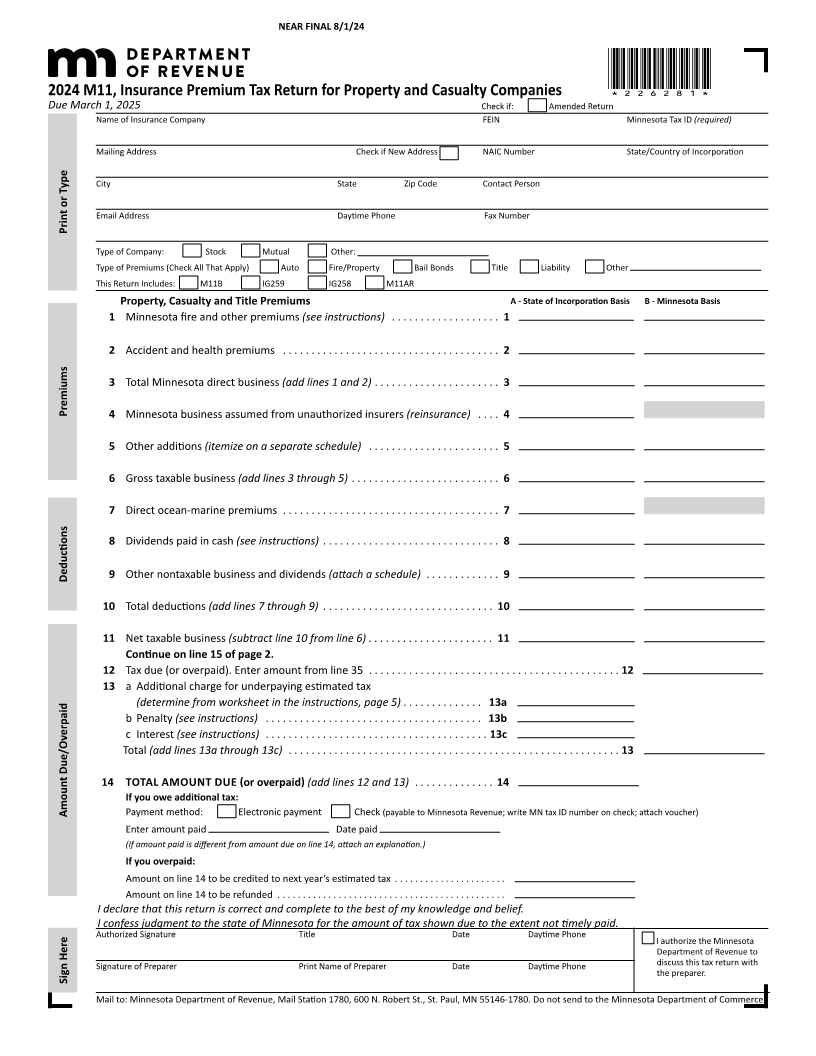

NEAR FINAL 8/1/24

*226281*

2024 M11, Insurance Premium Tax Return for Property and Casualty Companies

Due March 1, 2025 Check if: Amended Return

Name of Insurance Company FEIN Minnesota Tax ID (required)

Mailing Address Check if New Address NAIC Number State/Country of Incorporation

City State Zip Code Contact Person

Email Address Daytime Phone Fax Number

Print or Type

Type of Company: Stock Mutual Other:

Type of Premiums (Check All That Apply) Auto Fire/Property Bail Bonds Title Liability Other

This Return Includes: M11B IG259 IG258 M11AR

Property, Casualty and Title Premiums A - State of Incorporation Basis B - Minnesota Basis

1 Minnesota fire and other premiums (see instructions) . . . . . . . . . . . . . . . . . . . 1

2 Accident and health premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total Minnesota direct business (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . 3

Premiums 4 Minnesota business assumed from unauthorized insurers (reinsurance) . . . . 4

5 Other additions (itemize on a separate schedule) . . . . . . . . . . . . . . . . . . . . . . . 5

6 Gross taxable business (add lines 3 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Direct ocean-marine premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Dividends paid in cash (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Deductions 9 Other nontaxable business and dividends (attach a schedule) . . . . . . . . . . . . . 9

10 Total deductions (add lines 7 through 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Net taxable business (subtract line 10 from line 6) . . . . . . . . . . . . . . . . . . . . . . 11

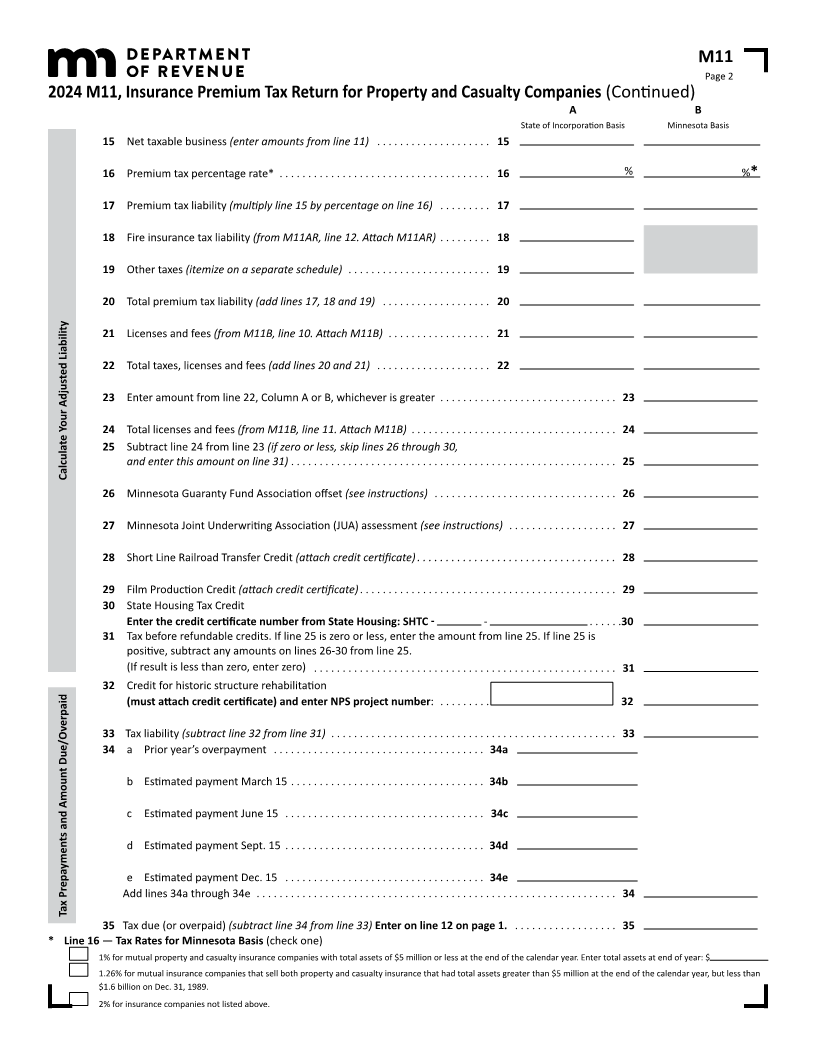

Continue on line 15 of page 2.

12 Tax due (or overpaid) . Enter amount from line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 a Additional charge for underpaying estimated tax

(determine from worksheet in the instructions, page 5) . . . . . . . . . . . . . . 13a

b Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13b

c Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13c

Total (add lines 13a through 13c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 TOTAL AMOUNT DUE (or overpaid ) (add lines 12 and 13) . . . . . . . . . . . . . . 14

If you owe additional tax:

Amount Due/Overpaid Payment method: Electronic payment Check (payable to Minnesota Revenue; write MN tax ID number on check; attach voucher)

Enter amount paid Date paid

(If amount paid is different from amount due on line 14, attach an explanation.)

If you overpaid:

Amount on line 14 to be credited to next year’s estimated tax . . . . . . . . . . . . . . . . . . . . . .

Amount on line 14 to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare that this return is correct and complete to the best of my knowledge and belief.

I confess judgment to the state of Minnesota for the amount of tax shown due to the extent not timely paid.

Authorized Signature Title Date Daytime Phone

I authorize the Minnesota

Department of Revenue to

Signature of Preparer Print Name of Preparer Date Daytime Phone discuss this tax return with

Sign Here the preparer .

Mail to: Minnesota Department of Revenue, Mail Station 1780, 600 N. Robert St., St. Paul, MN 55146-1780. Do not send to the Minnesota Department of Commerce.