Enlarge image

1350

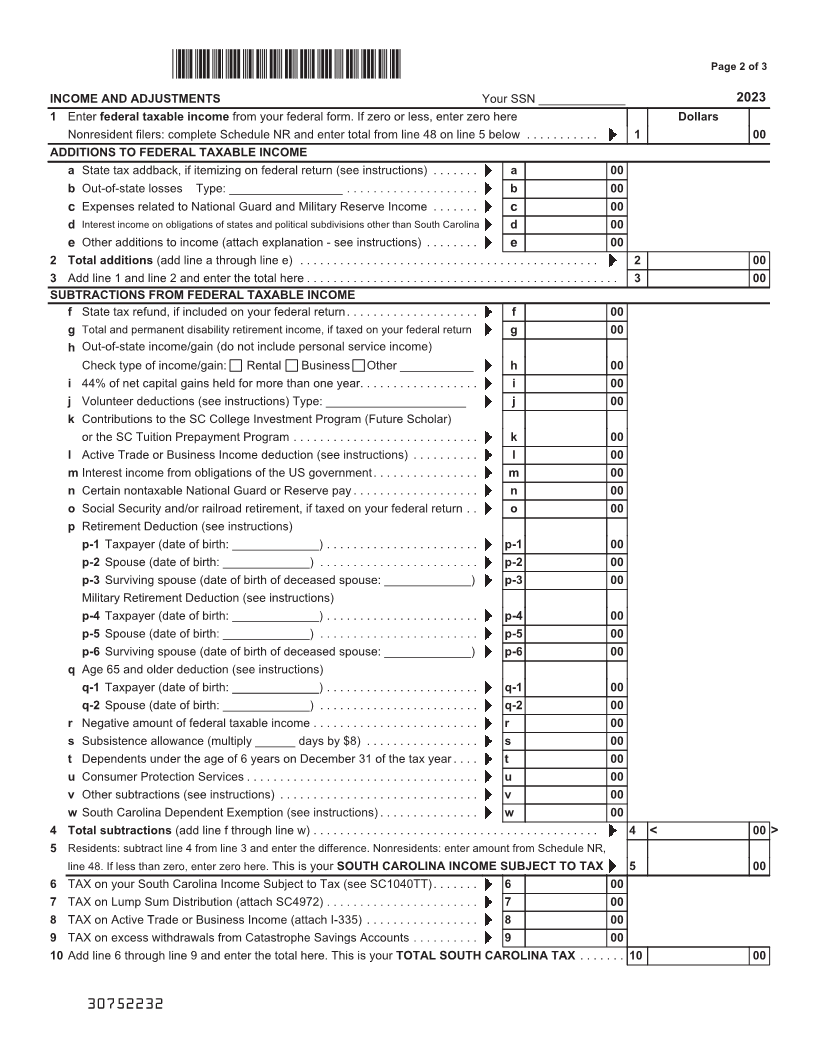

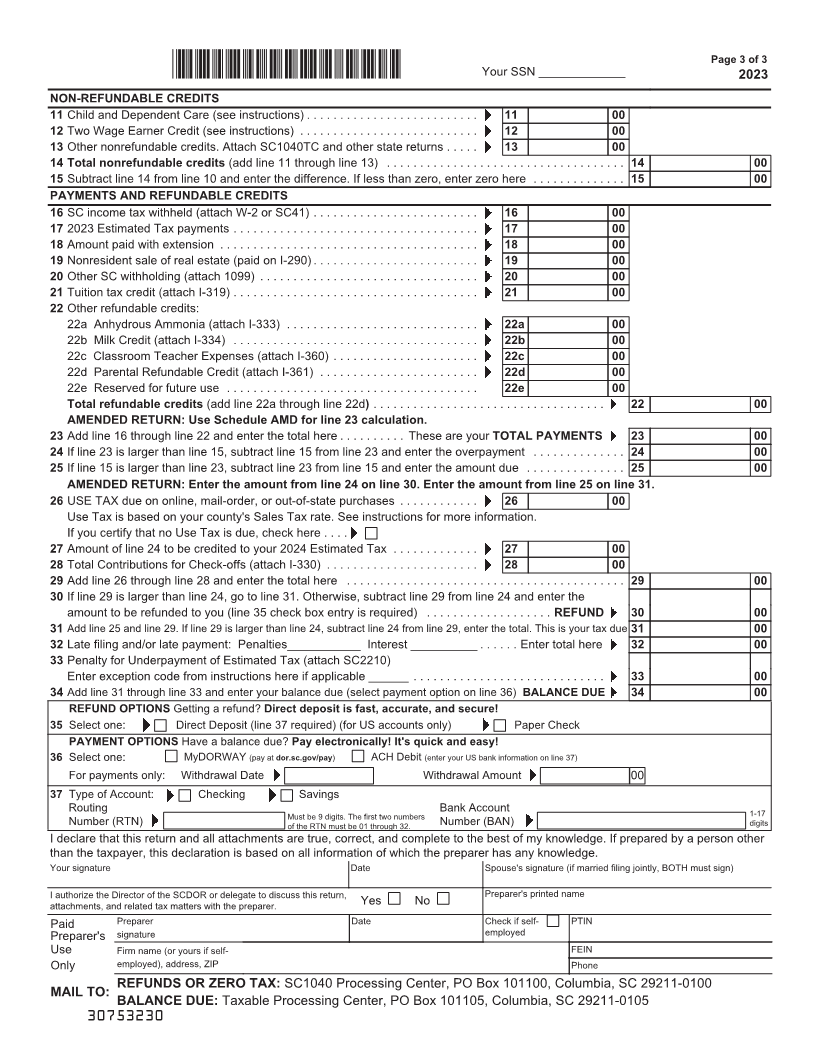

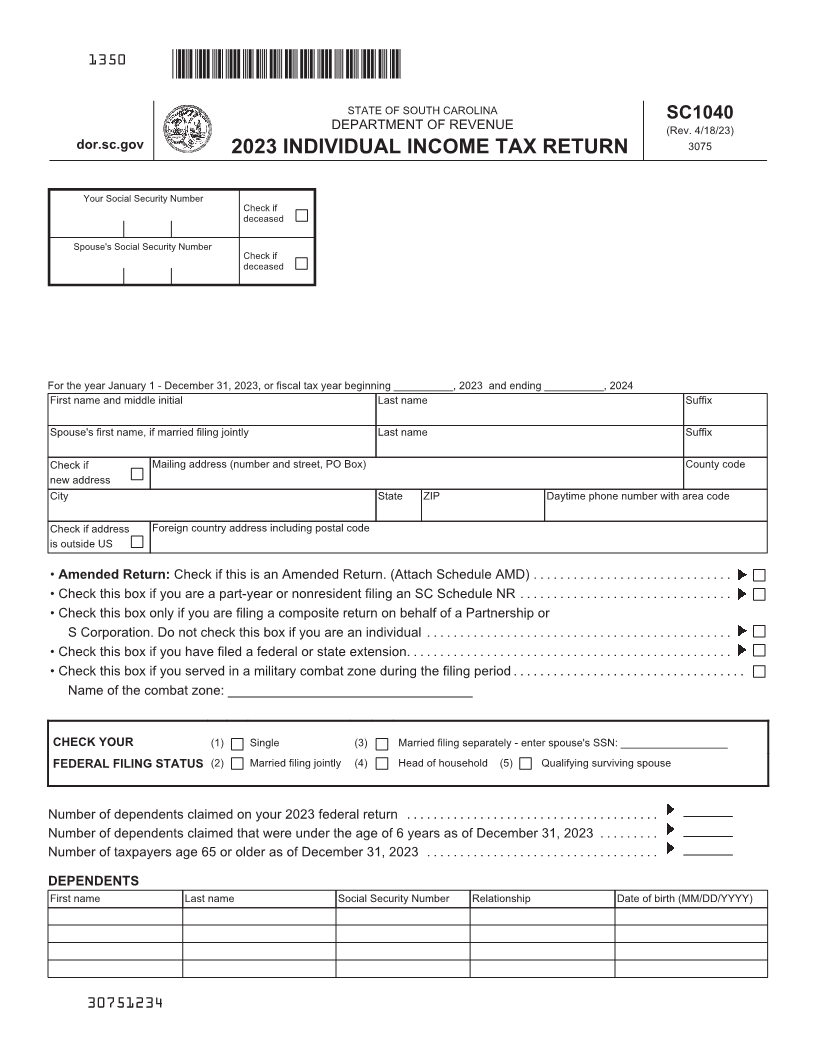

STATE OF SOUTH CAROLINA SC1040

DEPARTMENT OF REVENUE (Rev. 4/18/23)

dor.sc.gov 2023 INDIVIDUAL INCOME TAX RETURN 3075

Your Social Security Number

Check if

deceased

Spouse's Social Security Number

Check if

deceased

For the year January 1 - December 31, 2023, or fiscal tax year beginning __________, 2023 and ending __________, 2024

First name and middle initial Last name Suffix

Spouse's first name, if married filing jointly Last name Suffix

Check if Mailing address (number and street, PO Box) County code

new address

City State ZIP Daytime phone number with area code

Check if address Foreign country address including postal code

is outside US

• Amended Return: Check if this is an Amended Return. (Attach Schedule AMD) ..............................

• Check this box if you are a part-year or nonresident filing an SC Schedule NR ................................

• Check this box only if you are filing a composite return on behalf of a Partnership or

S Corporation. Do not check this box if you are an individual ..............................................

• Check this box if you have filed a federal or state extension.................................................

• Check this box if you served in a military combat zone during the filing period ...................................

Name of the combat zone: _________________________________

CHECK YOUR (1) Single (3) Married filing separately - enter spouse's SSN: __________________

FEDERAL FILING STATUS (2) Married filing jointly (4) Head of household (5) Qualifying surviving spouse

Number of dependents claimed on your 2023 federal return ......................................

Number of dependents claimed that were under the age of 6 years as of December 31, 2023 .........

Number of taxpayers age 65 or older as of December 31, 2023 ...................................

DEPENDENTS

First name Last name Social Security Number Relationship Date of birth (MM/DD/YYYY)

30751234