Enlarge image

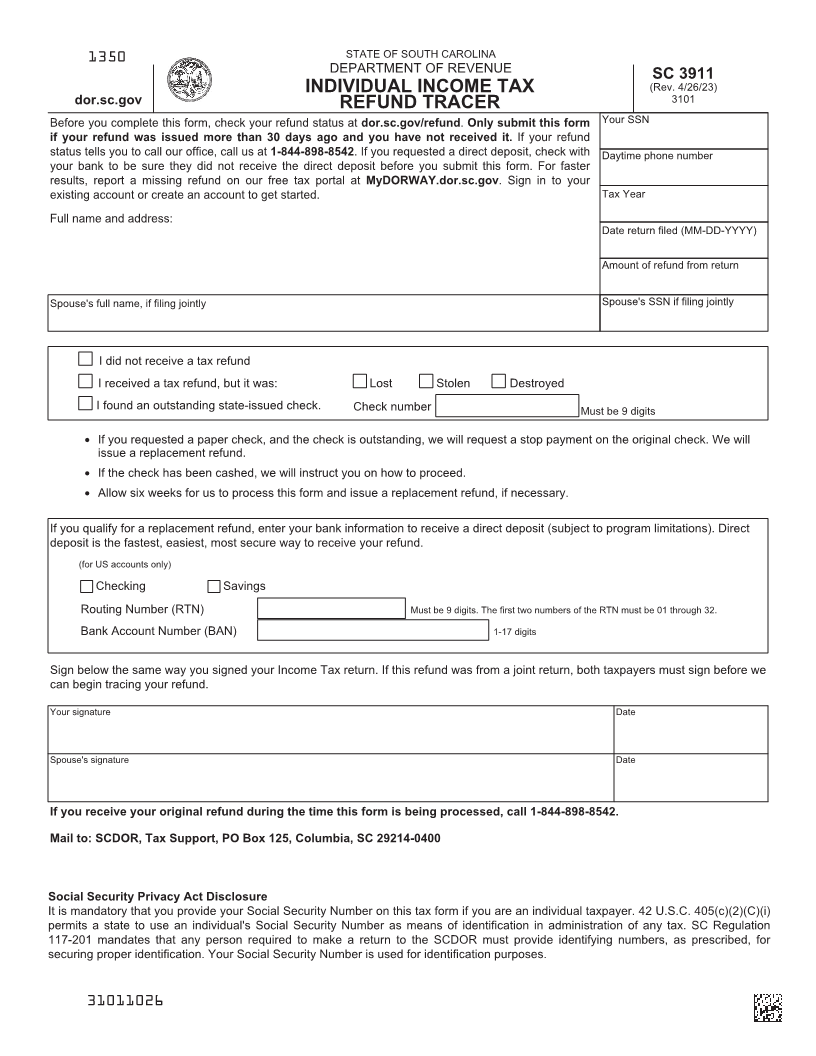

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

SC 3911

INDIVIDUAL INCOME TAX (Rev. 4/26/23)

dor.sc.gov REFUND TRACER 3101

Before you complete this form, check your refund status at dor.sc.gov/refund.Only submit this form Your SSN

if your refund was issued more than 30 days ago and you have not received it. If your refund

status tells you to call our office, call us at 1-844-898-8542. If you requested a direct deposit, check with Daytime phone number

your bank to be sure they did not receive the direct deposit before you submit this form. For faster

results, report a missing refund on our free tax portal at MyDORWAY.dor.sc.gov. Sign in to your

existing account or create an account to get started. Tax Year

Full name and address:

Date return filed (MM-DD-YYYY)

Amount of refund from return

Spouse's full name, if filing jointly Spouse's SSN if filing jointly

I did not receive a tax refund

I received a tax refund, but it was: Lost Stolen Destroyed

I found an outstanding state-issued check. Check number Must be 9 digits

• If you requested a paper check, and the check is outstanding, we will request a stop payment on the original check. We will

issue a replacement refund.

• If the check has been cashed, we will instruct you on how to proceed.

• Allow six weeks for us to process this form and issue a replacement refund, if necessary.

If you qualify for a replacement refund, enter your bank information to receive a direct deposit (subject to program limitations). Direct

deposit is the fastest, easiest, most secure way to receive your refund.

(for US accounts only)

Checking Savings

Routing Number (RTN) Must be 9 digits. The first two numbers of the RTN must be 01 through 32.

Bank Account Number (BAN) 1-17 digits

Sign below the same way you signed your Income Tax return. If this refund was from a joint return, both taxpayers must sign before we

can begin tracing your refund.

Your signature Date

Spouse's signature Date

If you receive your original refund during the time this form is being processed, call 1-844-898-8542.

Mail to: SCDOR, Tax Support, PO Box 125, Columbia, SC 29214-0400

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for

securing proper identification. Your Social Security Number is used for identification purposes.

31011026