Enlarge image

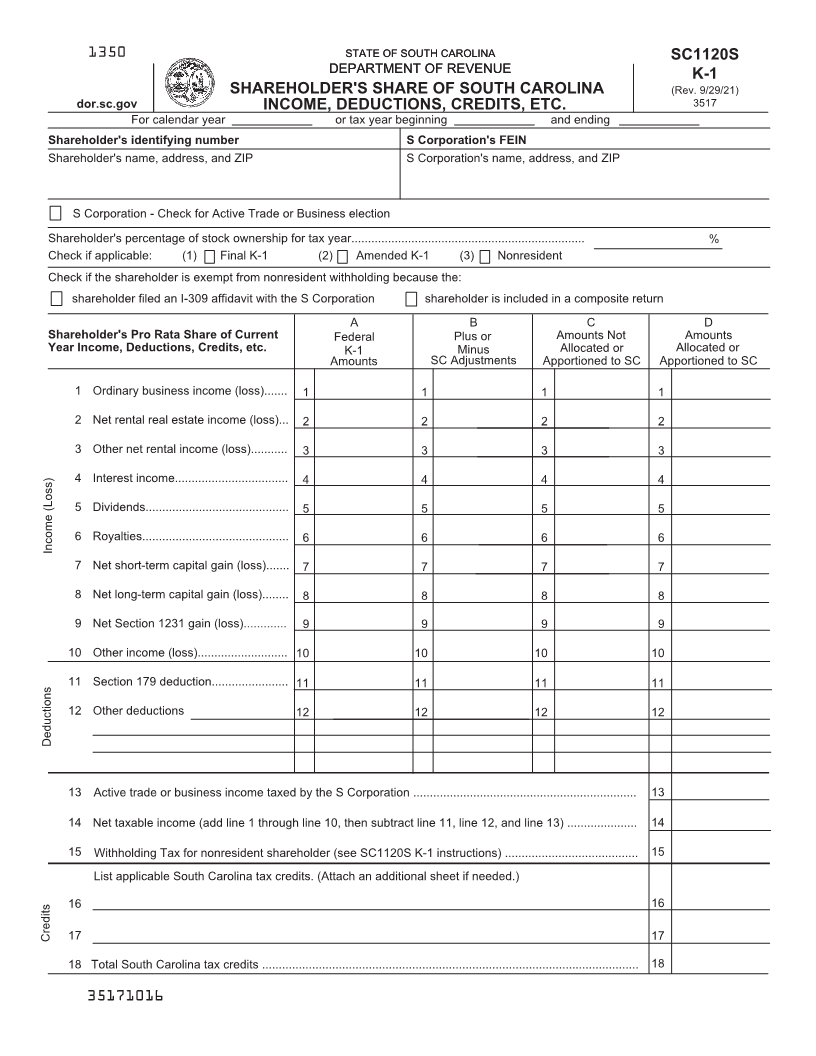

1350 STATE OF SOUTH CAROLINASTATE OF SOUTH CAROLINA SC1120S

DEPARTMENT OF REVENUEDEPARTMENT OF REVENUE K-1

SHAREHOLDER'S SHARE OF SOUTH CAROLINA (Rev. 9/29/21)

dor.sc.gov INCOME, DEDUCTIONS, CREDITS, ETC. 3517

For calendar year or tax year beginning and ending

Shareholder's identifying number S Corporation's FEIN

Shareholder's name, address, and ZIP S Corporation's name, address, and ZIP

S Corporation - Check for Active Trade or Business election

Shareholder's percentage of stock ownership for tax year...................................................................... %

Check if applicable: (1) Final K-1 (2) Amended K-1 (3) Nonresident

Check if the shareholder is exempt from nonresident withholding because the:

shareholder filed an I-309 affidavit with the S Corporation shareholder is included in a composite return

A B C D

Shareholder's Pro Rata Share of Current Federal Plus or Amounts Not Amounts

Year Income, Deductions, Credits, etc. K-1 Minus Allocated or Allocated or

Amounts SC Adjustments Apportioned to SC Apportioned to SC

1 Ordinary business income (loss)....... 1 1 1 1

2 Net rental real estate income (loss)... 2 2 2 2

3 Other net rental income (loss)........... 3 3 3 3

4 Interest income.................................. 4 4 4 4

5 Dividends........................................... 5 5 5 5

6 Royalties............................................ 6 6 6 6

Income (Loss)

7 Net short-term capital gain (loss)....... 7 7 7 7

8 Net long-term capital gain (loss)........ 8 8 8 8

9 Net Section 1231 gain (loss)............. 9 9 9 9

10 Other income (loss)........................... 10 10 10 10

11 Section 179 deduction....................... 11 11 11 11

12 Other deductions 12 12 12 12

Deductions

13 Active trade or business income taxed by the S Corporation ................................................................... 13

14 Net taxable income (add line 1 through line 10, then subtract line 11, line 12, and line 13) ..................... 14

15 Withholding Tax for nonresident shareholder (see SC1120S K-1 instructions) ........................................ 15

List applicable South Carolina tax credits. (Attach an additional sheet if needed.)

16 16

Credits 17 17

18 Total South Carolina tax credits ................................................................................................................. 18

35171016